FROM THE DESK

OF THE CEO

Today, I’m pleased to report that United Bancorporation is a vibrant, growing, and diversified banking franchise. The Corporation currently has 18 traditional bank branches with 21 offices and two wholly owned subsidiaries. Our business model is a powerful, evolving solution of banking verticals and niches that are intertwined to create a nimble, innovative enterprise. Our talented management team has extensive experience in leveraging niches into profitable lines of product mixes that position the bank for growth. Strategic opportunities in our region have the potential to generate more earnings beyond those of traditional banking.

FROM THE DESK

OF THE CEO

Today, I’m pleased to report that United Bancorporation is a vibrant, growing, and diversified banking franchise. The Corporation currently has 18 traditional bank branches with 21 offices and two wholly owned subsidiaries. Our business model is a powerful, evolving solution of banking verticals and niches that are intertwined to create a nimble, innovative enterprise. Our talented management team has extensive experience in leveraging niches into profitable lines of product mixes that position the bank for growth. Strategic opportunities in our region have the potential to generate more earnings beyond those of traditional banking.

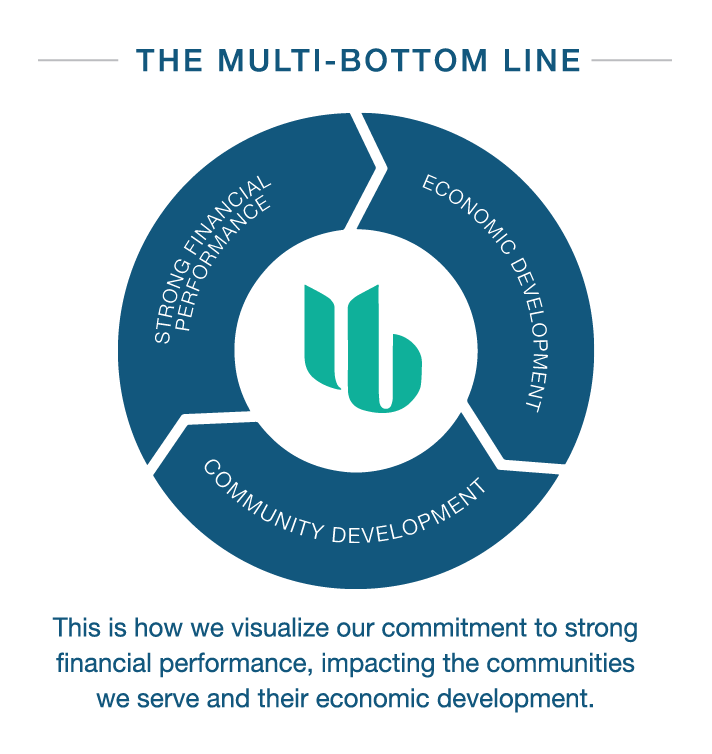

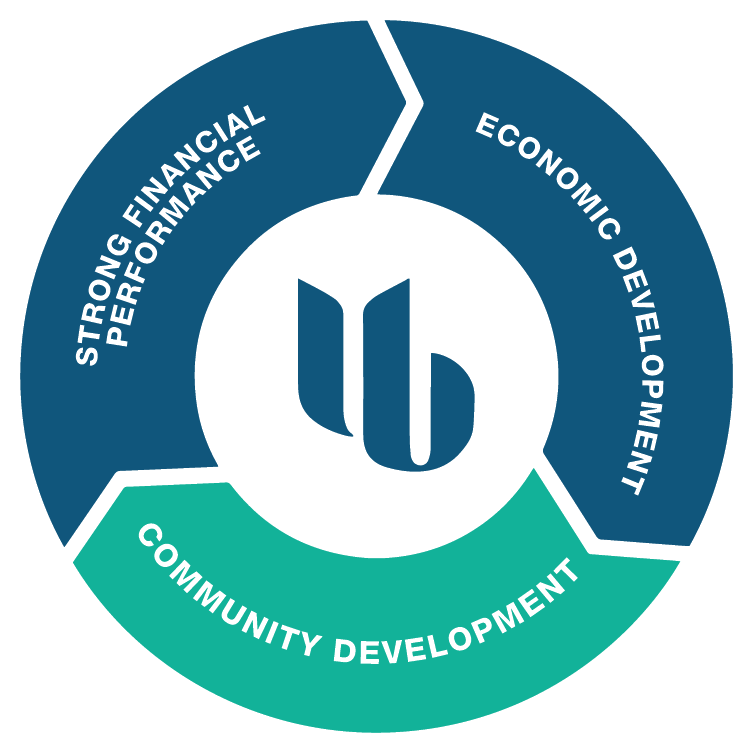

DOING WELL BY DOING GOOD

This foundational approach is designed to sustainably fuel our growth as a financial institution and make a transformative difference in the lives of our customers.

Being one of the first banks in Alabama to receive the Community Development Financial Institution (CDFI) certification, we’ve evolved into a multi-bottom line company.

These expanded capabilities and the focused business strategy positioned United Bank to build a niche business model and powerful brand. These capabilities allowed us not only to participate in the local markets, but to expand the local markets. Investing in local businesses, creating jobs, and enriching the quality of life in our communities brings us new lending opportunities, customer deposits, and stronger relationships. These cyclical relationships elevate our value, build our brand, give our customers the additional resources they need to be successful, and produce unprecedented financial results for our bank.

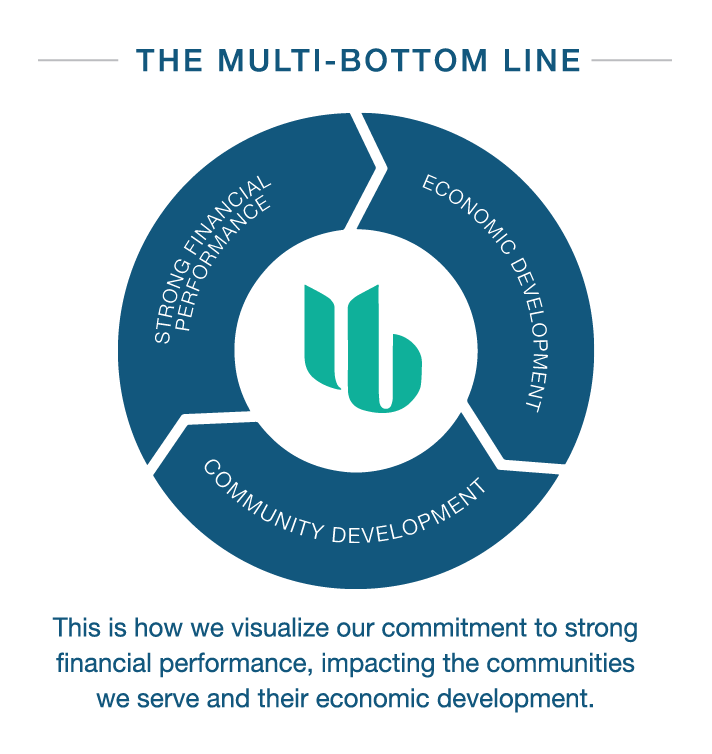

DOING WELL BY DOING GOOD

This foundational approach is designed to sustainably fuel our growth as a financial institution and make a transformative difference in the lives of our customers.

Being one of the first banks in Alabama to receive the Community Development Financial Institution (CDFI) certification, we’ve evolved into a multi-bottom line company.

These expanded capabilities and the focused business strategy positioned United Bank to build a niche business model and powerful brand. These capabilities allowed us not only to participate in the local markets, but to expand the local markets. Investing in local businesses, creating jobs, and enriching the quality of life in our communities brings us new lending opportunities, customer deposits, and stronger relationships. These cyclical relationships elevate our value, build our brand, give our customers the additional resources they need to be successful, and produce unprecedented financial results for our bank.

STRONG FINANCIAL PERFORMANCE |

|

Stable Core Deposits

Many consumers in our footprint still prefer a community bank. Which is why we’ve created a robust retail delivery system of branch offices strategically spread across our market area designed to provide a high level of service to customers wherever and whenever they want. This strategy has resulted in a strong, stable boost in core deposits, giving us low-cost access to funding we can use to grow our business and offer much-needed, affordable financial services to the areas we serve.

New Technology

Our recent investment in technology has allowed us to meet our customers’ needs for on-demand access and convenience, and also take advantage of new business opportunities. The conversion has transformed us into a learning organization while creating brand continuity throughout the customer journey.

Shareholder’s Dividend

United Bancorporation has paid a consistent dividend since 1983 and recently increased dividends from $.135 in 2017 to $.145 in 2018. In January 2019, the corporation paid a dividend of $.075 with a special dividend of $.005 for a total of $.08 per share. This increase reflects our improved financial performance and rewards our shareholders for their investment.

STRONG FINANCIAL PERFORMANCE

Stable Core Deposits

Many consumers in our footprint still prefer a community bank. Which is why we’ve created a robust retail delivery system of branch offices strategically spread across our market area designed to provide a high level of service to customers wherever and whenever they want. This strategy has resulted in a strong, stable boost in core deposits, giving us low-cost access to funding we can use to grow our business and offer much-needed, affordable financial services to the areas we serve.

New Technology

Our recent investment in technology has allowed us to meet our customers’ needs for on-demand access and convenience, and also take advantage of new business opportunities. The conversion has transformed us into a learning organization while creating brand continuity throughout the customer journey.

Shareholder’s Dividend

United Bancorporation has paid a consistent dividend since 1983 and recently increased dividends from $.135 in 2017 to $.145 in 2018. In January 2019, the corporation paid a dividend of $.075 with a special dividend of $.005 for a total of $.08 per share. This increase reflects our improved financial performance and rewards our shareholders for their investment.

ECONOMIC DEVELOPMENT |

|

Community banks are engines of small business growth, and our focus on creating opportunities goes beyond the extension of credit. The Church Street Incubator, mentorships, and business planning programs are perfect examples of our commitment to encouraging and supporting local small businesses.

In 2018 alone, we financed 372 small businesses totaling $70.2 million in loans, of which 123 were minority– and/or women-owned. We also counseled 94 small businesses on business planning, budgeting, and cash management. As we all know, small businesses’ success reverberates throughout the community, generating jobs, financial independence, and the entrepreneurial spirit .

We’ve also expanded this model with our Homegrown Startup Pitchfest contest which gives small, entrepreneurial startup businesses the opportunity to win $40,000 seed money.

This year marked the ninth consecutive year United Bank received the Bank Enterprise Award, which the U.S. Treasury Department awarded to only 119 institutions across the country. These resources allow us to further invest in programs by providing community impact services such as direct financing, checking and savings accounts, check cashing, financial services, and counseling.

ECONOMIC DEVELOPMENT

Community banks are engines of small business growth, and our focus on creating opportunities goes beyond the extension of credit. The Church Street Incubator, mentorships, and business planning programs are perfect examples of our commitment to encouraging and supporting local small businesses.

In 2018 alone, we financed 372 small businesses totaling $70.2 million in loans, of which 123 were minority– and/or women-owned. We also counseled 94 small businesses on business planning, budgeting, and cash management. As we all know, small businesses’ success reverberates throughout the community, generating jobs, financial independence, and the entrepreneurial spirit .

We’ve also expanded this model with our Homegrown Startup Pitchfest contest which gives small, entrepreneurial startup businesses the opportunity to win $40,000 seed money.

This year marked the ninth consecutive year United Bank received the Bank Enterprise Award, which the U.S. Treasury Department awarded to only 119 institutions across the country. These resources allow us to further invest in programs by providing community impact services such as direct financing, checking and savings accounts, check cashing, financial services, and counseling.

COMMUNITY DEVELOPMENT |

|

Communities thrive when people work together.

At United Bank, we realize we are all interconnected. Intertwined. The fate of our business is tied to that of our community. When our community is healthy, so are we. When our community soars, we rise with it.

When we help a business expand with New Market Tax Credits, we also make a loan and gain new banking customers. Jobs are created, tax bases are increased, homes are purchased, and the local economy grows.

When Capital Magnet Funds are used to help developers build affordable housing, the cycle of poverty is broken for area families, they began to participate in the local economy and become customers of our bank and other businesses. These businesses then grow, more jobs are created, and more money is invested back into our communities.

When our outreach and retail strategies drive growth for our bank, we can make more loans and increase our local investments. When we support innovators and entrepreneurs, the doors of opportunity are thrown open for many individuals and businesses throughout our region.

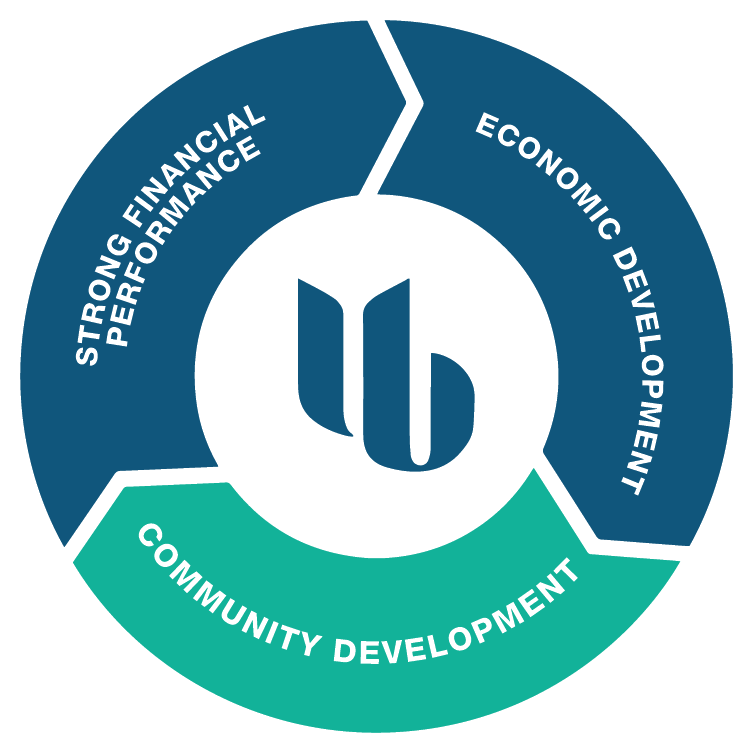

COMMUNITY DEVELOPMENT

Communities thrive when people work together.

At United Bank, we realize we are all interconnected. Intertwined. The fate of our business is tied to that of our community. When our community is healthy, so are we. When our community soars, we rise with it.

When we help a business expand with New Market Tax Credits, we also make a loan and gain new banking customers. Jobs are created, tax bases are increased, homes are purchased, and the local economy grows.

When Capital Magnet Funds are used to help developers build affordable housing, the cycle of poverty is broken for area families, they began to participate in the local economy and become customers of our bank and other businesses. These businesses then grow, more jobs are created, and more money is invested back into our communities.

When our outreach and retail strategies drive growth for our bank, we can make more loans and increase our local investments. When we support innovators and entrepreneurs, the doors of opportunity are thrown open for many individuals and businesses throughout our region.

2018 FINANCIAL PERFORMANCE

Basic Earnings Per Share$4.09Basic earnings per share increased from $1.44 per share to $4.10 per share in 2018. The total return performance for 2018 was 284%. |

Total Assets$637,584,383 |

Loans Held for Investment$409,843,750 |

Revenue$36,743,442 |

Net Earning Before Taxes$12,905,355 |

Stock Price$20.32 |

2018 FINANCIAL PERFORMANCE

Basic Earnings Per Share$4.09Basic earnings per share increased from $1.44 per share to $4.10 per share in 2018. The total return performance for 2018 was 284%. |

Total Assets$637,584,383 |

Loans Held for Investment$409,843,750 |

Revenue$36,743,442 |

Net Earning Before Taxes$12,905,355 |

Stock Price$20.32 |

2018 FINANCIAL PERFORMANCE

Basic Earnings Per Share$4.09Basic earnings per share increased from $1.44 per share to $4.10 per share in 2018. The total return performance for 2018 was 284%. |

Total Assets$637,584,383 |

Loans Held for Investment$409,843,750 |

Revenue$36,743,442 |

Net Earning Before Taxes$12,905,355 |

Stock Price$20.32 |