LETTER FROM BOB JONES

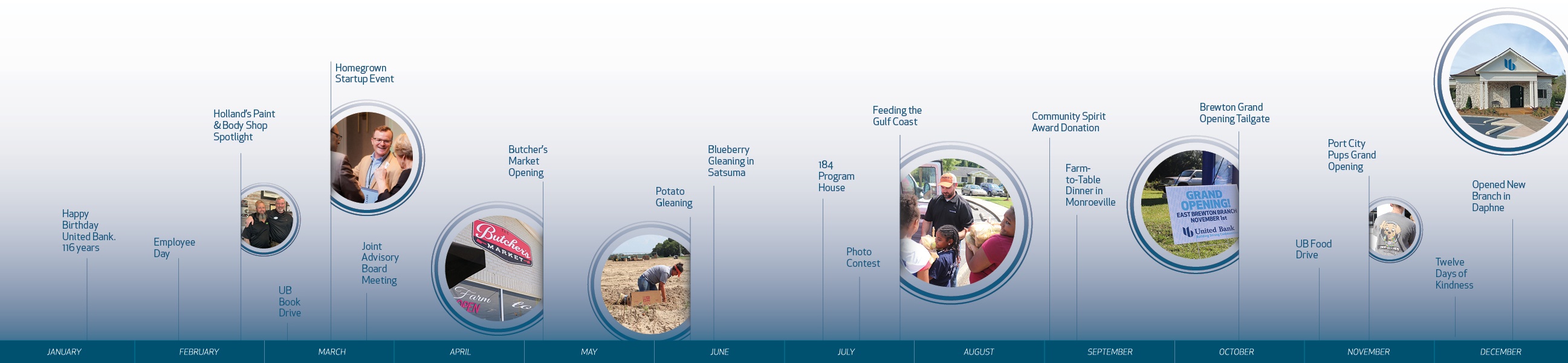

United had a tremendous year in 2019, made up of smart investment opportunities, organizational stability and strategic planning.

First, United completed a private placement of $26.25 million of its common stock in April. As a result, 1,312,500 shares of common stock were issued at a purchase price of $20.00 per share. Those funds have not only bolstered capital but also positioned the Company for future growth opportunities.

For the twelve months ending December 31, 2019, United Bancorporation of Alabama, Inc. reported net income of $9.78 million or $2.86 per diluted share compared to $9.9 million or $4.09 per diluted share for the twelve months of 2018. The $9.9 million includes a $4.0 million Capital Magnet Fund (CMF) awarded from the Community Development Financial Institution (CDFI) Fund to finance affordable housing projects. Without the award, 2018 net income would have been $6.8 million or $2.82 per diluted share. When compared to 2019, core earnings grew $2.9 million or 42.15%. Earnings per share also increased despite the additional shares issued through the capital raise.

AWARDS & RECOGNITION

The company was ranked 16th in the country in American Banker magazine’s annual list of the top 200 publicly traded banks with assets of less than $2 billion. The survey reviewed more than 600 banks across the country to compile the top 200 list. No other Alabama bank ranked in the top 100.

United Bank offers its employees benefits such as a 401(k) match and a profit-sharing contribution. It also provides tuition reimbursement for individuals desiring to attend banking school, such as the Alabama Banking School at the University of South Alabama. The bank also pays for continuing education for those seeking certification in a specialized area, such as commercial lending, marketing or compliance.

United Bancorporation of Alabama, Inc. was awarded a top 10 spot in the CB Resources, Inc. Top 10 Report for the third quarter of 2019. This places the Company among the top 10 percent of Community Banks nationally in their asset group based on key performance indicators.

AWARDS & RECOGNITION

The company was ranked 16th in the country in American Banker magazine’s annual list of the top 200 publicly traded banks with assets of less than $2 billion. The survey reviewed more than 600 banks across the country to compile the top 200 list. No other Alabama bank ranked in the top 100.

United Bank offers its employees benefits such as a 401(k) match and a profit-sharing contribution. It also provides tuition reimbursement for individuals desiring to attend banking school, such as the Alabama Banking School at the University of South Alabama. The bank also pays for continuing education for those seeking certification in a specialized area, such as commercial lending, marketing or compliance.

United Bancorporation of Alabama, Inc. was awarded a top 10 spot in the CB Resources, Inc. Top 10 Report for the third quarter of 2019. This places the Company among the top 10 percent of Community Banks nationally in their asset group based on key performance indicators.

LEADERSHIP PERSPECTIVE

Our company is fortunate to have a talented, cohesive and forward-looking team at the helm. Working together, they’ve accomplished great things this year and positioned us for even more strategic growth in the future. This year, we’ve asked each of them to provide their own recap and perspective on 2019 and what’s ahead for us.

Alex Jones

EVP, President, UBCD

UB Community Development (UBCD) operates across three unique lines of business: New Markets Tax Credits, Community Housing Capital and Community Facilities Lending. These lines of business allow UBCD to create value outside of the Bank’s historical geographic footprint.

Empowering people who power

our company.

2019 FINANCIALS

Earnings Per Share$2.86 |

Total Assets$727,497,858 |

Loans Held for Investment$455,124,946 |

Revenue$10,975,849 |

Net Earning Before Taxes$12,460,134 |

Stock Price$28.25 |

2019 FINANCIALS

Earnings Per Share$2.86 |

Total Assets$727,497,858 |

Loans Held for Investment$455,124,946 |

Revenue$10,975,849 |

Net Earning Before Taxes$12,460,134 |

Stock Price$28.25 |

2019 FINANCIALS

Earnings Per Share$2.86 |

Total Assets$727,497,858 |

Loans Held for Investment$455,124,946 |

Revenue$10,975,849 |

Net Earning Before Taxes$12,460,134 |

Stock Price$28.25 |